“In this world nothing can be said to be certain, except death and taxes.”

–Benjamin Franklin

Some time around 2011, the Washington State Department of Revenue started auditing nightclubs and running event organizers and levying large sales tax assessments. Not only did the DOR order us to immediately begin collecting sales tax on event registration fees, but they also billed us for years of back taxes plus penalties. We are still working to pay these off.

We (and, we think, the vast majority of other event producers) were doing our best to properly report and pay our taxes. Many in the running community questioned the fairness of penalizing us. There was also some discussion about the wisdom—in the midst of an obesity epidemic—of taxing running and dancing, while tickets for sitting in a stadium to watch professional sports went untaxed.

(You may have heard about this issue from the media attention, public protest, and legislative action in response to the “opportunity to dance” tax.)

While arguments regarding fairness and health seemed to fall on deaf ears in Olympia, ultimately the Department of Revenue got tired of enforcing this confusing tax law. It was at their request that the legislature finally took action, and HB 1550 was passed this spring to clarify the taxation of recreation activities. Martial arts dojos, whose recreation activities are newly taxable as retail sales, may not be happy, but the good news for runners is that, beginning January 1, 2016, run entries (along with the “opportunity to dance”) will no longer be subject to retail sales tax. Hooray!

What does this mean for Northwest Trail Runs and for you?

In order to make this change, we’ll take registration for our events offline starting at 5:00 PM December 31st and reopen them as soon as we have the changes made in the new year, but at least by sunrise on January 1st.

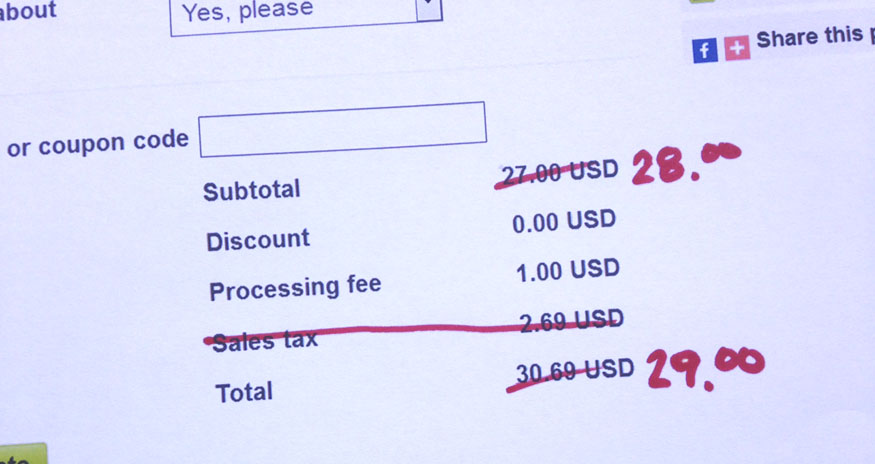

Along with the removal of sales tax comes a somewhat higher Business & Occupation tax rate, and we are raising entry fees for most runs by a small amount to cover this and other rising costs. But even with these price changes, we’re happy to say that the net effect for most of our runners will be a price decrease on registration fees with us in 2016! Apparel sales are still classified by the state as retailing, so if you purchase a T-shirt or other gear with your trail run entry, the tax-included price will be shown when you register.

Ten-Day New Year Sale!

As a celebration of the new year and the end of the sales tax on running events, we’re offering registration at special, super early (“Open”) prices on our spring and summer events, those in mid-March and later. You’ll already save money due to the removal of the sales tax, but you can save an additional few bucks off the already bargain Early registration prices, make a commitment to join us for some fun when the weather warms up, and cross “register for spring and summer trail runs” off your to-do list, when you register by January 10th.

Happy New Year! We hope your 2016 is filled with many happy miles on the trails.